Against a backdrop of a change of government and ongoing geopolitical uncertainty, the UK property market has remained very upbeat as we head towards the end of 2024.

Read more about the major events that have affected the market, how house prices have changed throughout the year, and what we might expect in 2025.

Average house prices in 2024 increased everywhere apart from London

According to the Office for National Statistics (ONS), average UK house prices increased by 2.9%, to £292,000, in the 12 months to September 2024, when data was last available.

This annual growth rate is up from 2.7% in the equivalent period up to the end of August 2024.

A comparison of the growth in the three different nations shows that house prices increased by:

- 2.5% in England to £309,000

- 0.4% in Wales to £217,000

- 5.7% in Scotland to £198,000, the highest rate of growth in the UK this year.

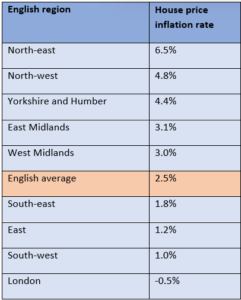

As you would expect, there have also been differences in house price inflation across the different English regions.

As you can see from the table, there was above-average growth in the north and Midlands, and below-average in the south and east. Meanwhile, in London, average prices have fallen.

Source: Office for National Statistics

The overall rise in values can be attributed to a range of factors including:

- Increased income as wage rises reflected the increase in inflation in 2022/23

- The subsequent fall in the rate of inflation boosting consumer confidence

- The first cut in the Bank of England (BoE) base rate since the pandemic.

Indeed, according to Zoopla, buyer demand is up 26% annually and sales agreed are up by 25%.

Looking ahead, Propertywire revealed that leading estate agents, Knight Frank, predict prices will continue to increase at a similar rate in 2025, by 2.5%.

In the longer-term projection, the same report confirms that Hamptons are projecting a 19.3% increase in property values over the next five years.

The cost of borrowing started to come down in 2024

Mortgage interest rates are one of the key drivers when it comes to the health of the property market.

As you may recall, to help boost demand and reduce the cost of borrowing, the BoE cut its base rate to 0.1% during the pandemic.

However, in the wake of big increases in the rate of inflation, the base rate rose steeply from the end of 2021 as the Bank increased rates to reduce consumer demand.

As a result, rates peaked at 5.25% in August 2023 and were only reduced to 5% a year later, followed by a further 0.25% cut to 4.75% in November.

According to Zoopla, these recent rate cuts have resulted in 2024 “turning into a bumper year for housing sales”, with competition among lenders driving mortgage rates to their lowest for two years.

With earnings increasing, Zoopla says that the market has seen the highest level of new sales agreed since the immediate post-pandemic boom in 2022.

While the Guardian reported in November that the average two-year fixed-rate mortgage deal was 5.51%, there are still competitive rates on offer. Moneyfacts confirms that the best two-year fixed-rate mortgage is currently 4.22% (December 2024) and the best five-year rate is a similar 4.14%.

No one is predicting future interest rates with any certainty

Perhaps understandably, there is no consensus around future interest rate changes.

For example, a report in the Guardian highlights Goldman Sachs predicting that the BoE base rate will fall to 2.75% by November 2025. Meanwhile, This is Money reports that Santander believes a rate of 3.75% by the end of 2025 is more likely.

More pessimistically still, Zoopla believe rates will settle in the 4-4.5% range throughout next year.

While the BoE did reduce the base rate from 5% to 4.75% last month, the recent rise in inflation to 2.3% as confirmed by the ONS may preclude another rate reduction, at least in the short term.

However, according to This is Money, the Bank expects the rate of inflation to hover just above 2% until 2027, which would suggest the longer-term prospects remain positive.

It is important to remember, however, that external events could easily make the best-informed projections redundant.

For example, the strong suggestion from the recently re-elected US President Trump that he sees tariff barriers as an important part of his economic policy could drive inflation up here in the UK, as exports to our largest market could become prohibitively expensive.

A BBC report suggested this could cost the UK £22 billion in lost exports, and this may influence the BoE decision-making in the coming months.

Additionally, government plans to borrow and spend billions to improve public services have changed expectations.

Overall, financial markets and the BoE itself now expect rates to be cut more slowly than previously anticipated.

Changes to Stamp Duty could affect your property purchase plans

Aside from interest rates, tax changes could also be relevant. Indeed, the chancellor announced two impactful changes to Stamp Duty Land Tax (SDLT) in her Budget statement on 30 October.

She confirmed an immediate increase in the SDLT surcharge from 3% to 5%. This is the additional SDLT amount payable on the purchase of any property that is not your main residence.

Clearly, this will affect you if you are buying a second property, or have an existing buy-to-let property portfolio that you are looking to add to.

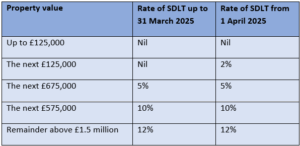

Furthermore, the SDLT holiday that was introduced to help boost the housing market will be removed from April 2025.

This will mean that you will be liable for SDLT if you buy a property with a value in excess of £125,000 rather than £250,000.

The table shows the applicable rates of SDLT if you are buying a new main residence.

Source: Government website

Additionally, the first-time buyer threshold will be reduced from £425,000 to £300,000, meaning you will pay SDLT on the value of property exceeding £300,000 if you are buying your first home.

Get in touch

If you would like support managing your wealth, then please do get in touch with us at DBL Asset Management.

Email enquiries@dbl-am.com or call 01625 529 499 to speak to us today.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.