On 2 February, the Bank of England raised the base rate to 4%, the highest the rate has been in 14 years.

Rising interest rates are posing challenges for many people who have seen their mortgage repayments go up dramatically. Many have struggled to meet the increased cost, especially on top of other cost of living issues, such as rising energy prices.

Those on variable and tracker-rate mortgages will likely have already seen their repayments increase, while MoneyWeek reports that a further 1.4 million households are going to face higher costs later this year as fixed-rate mortgages come to an end.

If you are in the fortunate position of being able to easily afford your monthly repayments, and have some scope in your monthly household budget, you may well have thought about overpaying on your mortgage each month.

Alternatively, you may have considered investing money on a regular basis instead, with a view to accumulating a sufficient sum to pay off your mortgage at a later date.

Read on to find out more about the advantages of overpaying your mortgage, or whether it could be better to invest your money instead.

Overpaying your mortgage can save you a lot of money

Your mortgage repayments are typically based on three factors: the interest rate, the amount of your loan, and the term of the mortgage.

By overpaying your mortgage, either with a lump sum of money, or by increasing your monthly repayments, you can effectively reduce the term of the loan.

This can be particularly advantageous if interest rates are rising, as your additional contributions will reduce the amount of capital outstanding at a faster rate.

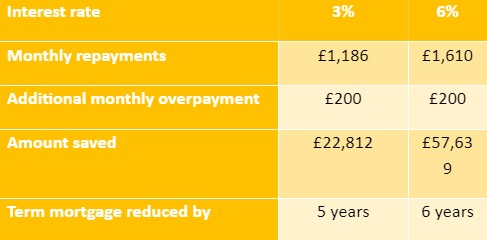

The table below illustrates the benefit of paying extra each month on your mortgage, and the enhanced benefit if interest rates rise.

All figures are based on a mortgage of £250,000 being repaid on a capital and interest basis over a 25-year term.

Source: Halifax

As you can clearly see, committing to overpaying your mortgage can save you a lot of money. Additionally, by reducing the term, you will be freeing up spare capital for other uses.

The MoneySavingExpert website has a very useful calculator that you can use to inform your decision and show you how much you could save.

Bear in mind that you may face early repayment charges (ERCs) when overpaying by a certain amount. Check with your lender whether you will need to pay ERCs before you make any overpayments.

There are other benefits of overpaying as well as saving money

Reducing the term of your mortgage does not just save you money. It can also have wider implications that can help you manage your wealth and secure your financial future.

For example, by becoming mortgage-free sooner, you could free up money that you can put to good use for other purposes. That might be giving your pension fund a boost, or helping your children get on the housing ladder themselves.

It can also help reduce your loan-to-value (LTV) rate on your existing mortgage. By doing this, you may be able to remortgage onto a better rate and further improve your financial position.

You should review your wider finances

Before you decide to overpay, you should be certain that it is the best use of spare money you have each month.

For example, if you have unsecured debts such as credit cards, the high rates of interest you are probably paying mean that it may be sensible to prioritise clearing them before focusing on your mortgage.

Once you have done this, you may well find that you have freed up even more money that you can then commit to reducing your mortgage.

You should also ensure you have an emergency fund in place, to deal with any unforeseen events where instant access to money is important, such as a broken boiler or a leaking roof.

Investing the money instead could be beneficial

Another aspect of your financial review may well be to consider if you want to invest the money, rather than using it to overpay your mortgage.

Investing money into a portfolio of shares and other investments over an extended period has historically been a reliable way to grow your wealth.

However, the nature of stock markets is that they inherently fluctuate. This means that to mitigate the risk of market upheaval affecting your future wealth, you should look to keep your money invested for an extended period.

If you are able to commit to investing regularly, then you may well find yourself in an advantageous position.

For example, if you were to invest £200 each month, rather than overpay your mortgage by this amount, figures provided by CalculatorSite show that a gross 5% annual return, before charges, would provide you with a fund in excess of £80,000 after 20 years.

Based on the figures in the table, you would then be in a position to pay off your mortgage early, with an additional sum to use elsewhere. Alternatively, you could regularly review your investment value, and use it to repay your mortgage when it is of a sufficient size.

Your decision will be driven by your personal circumstances

There is no one correct answer when it comes to choosing whether to overpay your mortgage each month or invest your money. The choice will come down to your personal circumstances, financial priorities, and attitude to investment risk.

For example, if you are close to retirement, you should arguably focus on paying off your mortgage, rather than having mortgage debt hanging over you after you have retired.

But if you are younger, there may well be an argument for investing any spare cash to take advantage of time in the market.

Get in touch

If you are facing the choices you have read about in this article, then please do get in touch with us at DBL Asset Management.

We can provide personalised advice on the most sensible course of action, based on your specific circumstances.

Email enquiries@dbl-am.com or call 01625 529 499 to speak to us today.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Your home may be repossessed if you do not keep up repayments on your mortgage.