In her 2025 Budget statement, the chancellor, Rachel Reeves, maintained the pre-election pledge made by the government not to increase Income Tax, National Insurance contributions (NICs), or VAT.

However, her announcement of a further extension to the freeze on Income Tax thresholds is likely to leave you with a higher tax bill, even though the underlying rates remain unchanged.

Find out why that is the case and read about some simple steps you can take to potentially mitigate the effects of the freeze.

The freeze on Income Tax thresholds began in 2021

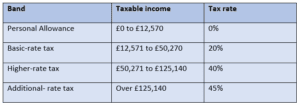

The amount of Income Tax you pay is determined by the income levels at which different rates start to apply.

Until 2021, the Income Tax thresholds tended to increase each year in line with inflation. This meant that you were not necessarily pushed into a higher tax bracket if your income went up.

However, in the Budget of that year, the then chancellor, Rishi Sunak, announced that the Personal Allowance and Income Tax thresholds would be frozen at the 2021/22 levels for the four years up to and including 2025/26.

Chancellor Jeremy Hunt then extended this freeze for a further two years, to 2027/28.

The current chancellor has now extended it again, and it is set to be maintained until 2030/31.

This means that if your income goes up each year in line with inflation, but thresholds do not, a larger proportion of your wealth will be subject to a higher rate of tax.

The resulting fiscal drag could affect you if you earn close to an Income Tax threshold

Because the Income Tax thresholds are not increasing with inflation, more of your income could fall into higher tax bands, even though your overall financial position has not improved.

For example:

- If your salary is currently £50,270, your highest rate of tax will be 20%.

- A 3% pay increase (roughly in line with the current rate of inflation) will mean you now earn £51,778.

- The freeze on the higher-rate threshold means that the additional £1,508 is taxed at 40% instead of 20%. This means your tax bill is over £300 higher than it would have been if you paid 20% on all your earnings.

This erosion, which is known as fiscal drag, is cumulative and can have a significant effect on your earnings over time.

Other taxes you may be liable for could be affected by the freeze

Your applicable Income Tax band can also affect other taxes you may be liable for.

For example, the rate at which you pay Capital Gains Tax (CGT) is dependent on your Income Tax rate.

Any capital gains in excess of the Annual Exempt Amount of £3,000 in the 2025/26 tax year will be subject to CGT at the rates 18% (basic rate) and/or 24% (higher rate). If you are a basic-rate taxpayer but your gains push your total income above the higher rate threshold, a portion of the gain is taxed at the basic rate while the rest is taxed at the higher rate.

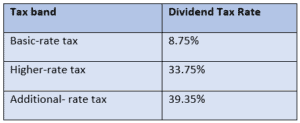

Likewise, your marginal Income Tax rate will also affect how much Dividend Tax you pay on income you take from your investments.

During the recent Budget, the chancellor announced that the basic and higher rates of Dividend Tax will increase by 2 percentage points from April 2026. This rise, combined with fiscal drag, could mean you pay significantly more tax on dividend income than you did previously.

3 simple ways to reduce your taxable income

As you can appreciate, the effect of a threshold freeze, which might result in a higher marginal rate of tax, could have a marked impact on your personal finances.

Because of that, it can make sound financial sense to reduce your taxable income to prevent moving into a higher tax band, if at all possible.

Here are three effective ways you can achieve this:

1. Maximise your pension contributions

If you are close to an Income Tax threshold, increasing your contributions to a workplace or personal pension can reduce your taxable income, and keep you in a lower tax band.

2. Join any salary sacrifice scheme offered by your employer

Salary sacrifice pension contributions are deducted from your gross salary before Income Tax and National Insurance (NI) are calculated. As well as helping you make savings on the amount of NI you pay, they can also keep you in a lower tax band.

Be aware that contributions under a salary sacrifice arrangement will be restricted from 2029, so it could be advantageous to maximise the opportunity to reduce your liability now, if you are able to.

3. Ensure you are claiming all the expenses you are entitled to

If you are self-employed or spend your own money on job-related expenses as an employee, such as business mileage and tools, claiming the eligible relief could reduce your Income Tax liability and prevent you paying a higher rate of tax.

Get in touch

Given the effect of higher rates of tax, it is clearly important to review tax planning regularly, both in terms of the amount of Income Tax you pay and to ensure your investment and savings strategies are as tax-efficient as possible.

If you would like to talk to us about your own arrangements, please get in touch.

You can email enquiries@dbl-am.com or call 01625 529 499 to speak to us today.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate tax planning.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.