If you are a self-employed business owner or landlord, you likely need to file a tax return each year to report your income and calculate your tax liability.

Any mistakes on your return could mean you underpay tax, potentially leading to penalties. On the other hand, you can use your tax return to take advantage of certain allowances and exemptions, reducing your tax liability.

The “Making Tax Digital” scheme, coming into place from April 2026 onwards, could change the way you file your taxes. It is important to understand what is changing and how you might be affected so you can continue managing your tax liability carefully.

Read on to learn everything you need to know.

You will be required to provide quarterly tax reports and a final declaration

Currently, if you earn more than £1,000 from self-employment or property income in a given tax year, you must file a self-assessment tax return by 31 January the following year.

One of the key changes under the Making Tax Digital scheme is the introduction of quarterly reporting. This means you will need to file four quarterly reports throughout the year. You will also complete a final declaration, which is similar to your current tax return.

Consequently, reporting your earnings and calculating your tax liability may become more complex and time intensive as you need to keep consistent records. Small businesses or sole traders, in particular, may feel the effects of a much larger administrative burden.

Additionally, you might find it more difficult to understand how certain allowances and exemptions apply, and when you need to report these.

Despite these challenges, quarterly reporting could benefit you as it means you have a clearer picture of your tax liability and upcoming payments throughout the year.

All records must be digital and kept on software approved by HMRC

The other main element of the new scheme is that records must be digital, rather than physical, and you must use specific software approved by HMRC. If you are currently using paper records or keeping data on a spreadsheet, you will likely need to translate this to a dedicated bookkeeping tool to remain compliant.

You can use the HMRC find software tool to search for applications that meet the standards for digital record keeping.

Depending on the software you choose, you may incur additional costs. There may also be a transition period while you move from your old system to the new one, creating complexity in your bookkeeping.

It is important that you remain accurate with your reporting because HMRC are planning to introduce a new penalty system for late or incorrect submissions.

The changes will begin rolling out from April 2026

Making Tax Digital was originally planned to take effect from April 2023 but was delayed while the government made amendments to the proposed legislation.

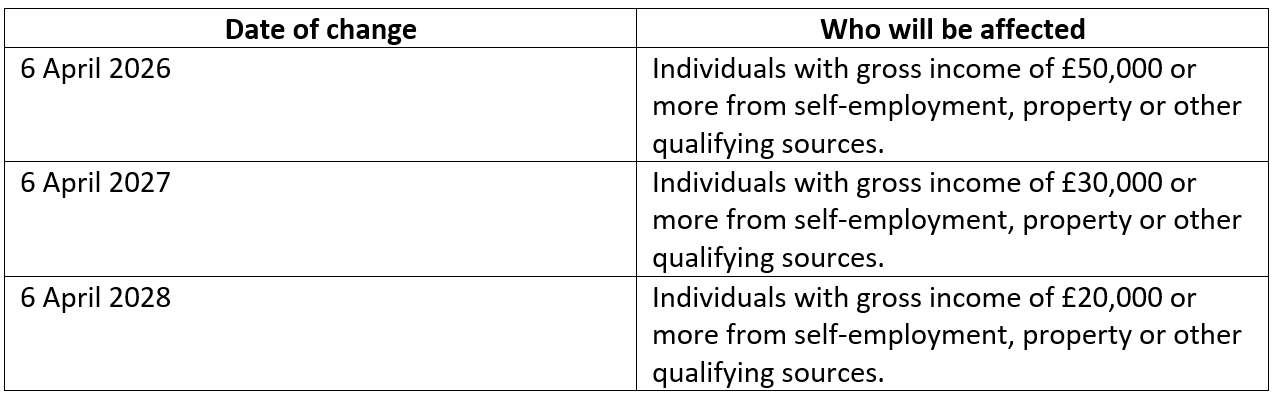

Now, the new scheme will be rolled out from April 2026 with a staggered introduction based on your earnings.

The following table shows how this will work.

Source: UK government

It is important to take note of when the new rules will affect you, so you can prepare ahead of time and ensure you remain compliant.

Your financial planner can help you prepare for the transition to Making Tax Digital

HMRC states that Making Tax Digital will improve efficiency and reduce mistakes with tax reporting. However, for self-employed business owners and landlords, it could lead to increased confusion and a larger administrative load.

We can support you with the transition, helping you keep compliant records so you can report your income accurately and avoid penalties.

More importantly, we can explain how the new scheme will affect certain tax allowances and exemptions, and when you might need to include these in quarterly reports or your final declaration.

As a result, you can continue benefitting from all available allowances and exemptions, meaning you can manage your tax liability more effectively.

Get in touch

If you need help understanding and managing your tax liability then please do get in touch with us at DBL Asset Management.

Email enquiries@dbl-am.com or call 01625 529 499 to speak to us today.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate tax planning.