High inflation and the cost of living crisis seem to be constantly in the headlines in 2022.

According to the Office for National Statistics (ONS) inflation, as measured by the Consumer Price Index (CPI), reached 9% in the 12 months to April 2022. That makes it the fastest rate of growth in 40 years.

As prices continue to rise, it can feel like reducing your expenditure and saving more are high priorities. However, one area you may not want to skimp on is your pension contributions.

While it may seem like a sensible course of action to cut back on your pension savings and have access to your money now, this strategy could actually do you more damage down the line than you think.

Yet worryingly, Aegon research published in Pensions Age suggests that many individuals may be tempted to do exactly that in this inflationary environment.

Find out why you may want to keep paying into your pension, even as inflation continues to climb.

Reducing your contributions could see you miss out on thousands of pounds

The reason that reducing your pension contributions may be the wrong way to go is demonstrated by some rather stark figures in the Aegon research.

Using the example of a 25-year-old on average earnings and contributing the minimum auto-enrolment amount of 8% of their qualifying earnings (equivalent to a 3% employer and 5% employee contribution, or 4% after basic-rate tax relief) into their pension fund each month, the study then estimated the impact of stopping pension contributions for a period of one, two, and three years.

The Aegon research estimates that, if this individual stopped paying into their pension for a year, they could be £4,600 worse off by the time they reach the State Pension Age.

Meanwhile, stopping contributions for two or three years could even cost them £9,100 and £13,600 respectively.

As you can see, prioritising your short-term needs could cost you in the value of your pension pot in the future.

The closer to retirement, the more important pension contributions are in an inflationary environment

This becomes even more relevant the closer you are to retirement, as this example from AJ Bell and published in the Telegraph demonstrates.

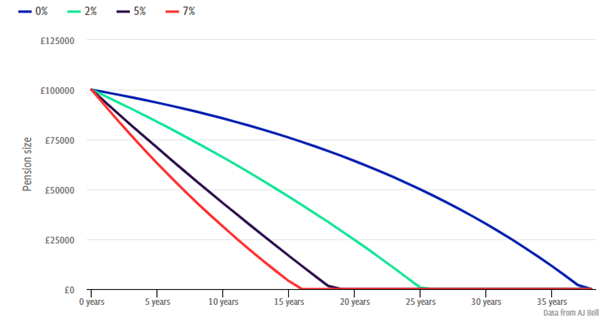

The case study considers an individual with a £100,000 pension fund who intends to draw £5,000 each year in retirement.

Assuming 4% investment growth net of charges, the graph below shows how long these funds would last, depending on the rate of inflation:

Source: AJ Bell via the Telegraph

In this example, inflation essentially wipes years off the value of the pension, as this individual would need to spend more to support their lifestyle.

This would only be worsened by reducing pension contributions, as the overall value of your fund would ultimately be smaller and thus be depleted even sooner.

As a result, reducing your contributions to live on in the short term may see you miss out on important pension growth that could have provided valuable income in later life, particularly if the current rate of inflation continues.

Be careful not to hold too much in savings

In this current period of uncertainty, you may think that reducing your pension contributions and holding that money readily available in a cash savings account may be more prudent.

However, a somewhat ironic knock-on effect of reducing your pension contributions is that it may actually increase your exposure to inflation if you hold more of your money in a savings account.

Consider this comparison between the rate of inflation and the interest rate on a standard savings account.

According to data provider Moneyfacts, the highest available interest rate on an easy access savings account was 1.52% on 13 June 2022.

So, £10,000 in that account would receive £152 interest, giving you a total of £10,152 over the course of a year.

However, an inflation rate of 9% sees goods and services that would have cost £10,000 last year now cost £10,900.

As you can see, that means the spending power of your money is reduced in real terms, as it can no longer purchase the same amount of goods and services it could the year before.

As a result, reducing your pension contributions and holding your money in savings may actually put your money at greater risk of losing value compared with the wider economy.

Of course, it is worth remembering that pension funds cannot be accessed until age 55 (rising to age 57 from 2028). So, it is important not to tie up funds that you might need to live on before age 55/57.

Increasing pension contributions may make more sense

Indeed, during this period, it may contrarily make more sense to actually increase your pension contributions, rather than reduce them.

There are two ways you can benefit from doing so: firstly, from the tax relief that will be applied to your contributions, and then from the potential investment returns your pot could generate.

Individuals receive tax relief on their pension contributions at their marginal rate of Income Tax. If you are a higher- or additional-rate taxpayer, you can claim this additional relief through your self-assessment tax return.

You can contribute and receive tax relief on personal contributions up to 100% of your earnings, or £3,600 if more, each tax year.

If your and your employer’s total pension contributions exceed the Annual Allowance (£40,000 for most people) you will be taxed on the excess (unless the excess can be covered using carry forward).

So, rather than reducing your contributions, increasing them could allow you to make the most of the tax relief on offer, giving your money greater chance of keeping up with the rate of inflation.

Additionally, there is the potential for investment returns on those contributions as your pot grows. Pension savings are typically invested for you by your scheme provider, which could see them keep up with the rate of inflation more effectively than a savings account.

In combination, the tax relief and investment returns can mean it makes more sense to keep steady or even increase your contributions, perhaps giving your money a better chance of staying ahead of rising inflation.

Speak to us

If you would like to find out how you can best manage your money during periods of high inflation, please do contact us at DBL Asset Management.

Email enquiries@dbl-am.com or call 01625 529 499 to find out how we could help you.

Please note

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.