“In this world nothing can be said to be certain, except death and taxes.”

American founding father Benjamin Franklin is famed for having said these words in a letter in 1789, and they are arguably just as true today as ever before. Just like death, tax is an inevitable part of life.

That said, it is still important to meticulously keep an eye on your Income Tax position throughout the year. Whether you fill out a self-assessment tax return in January or are handed a P60 by your employer when a new tax year starts in April, it is vital to check that the tax bill you have paid is all correct.

Unfortunately, this is not always the case. In fact, charity TaxAid report that as many as 15% of Pay As You Earn (PAYE) taxpayers pay too much or too little tax at source.

There are various reasons that this may be the case for you. For example, you might have more than one job, which could either see your tax-free Personal Allowance duplicated or the wrong tax code being applied to you.

Meanwhile, it could also occur as a result of the misprocessing of important forms, such as a P45 by a former employer. Incidents like these could see the tax bill you have to pay be miscalculated, leading you to pay more or less tax than you actually owe.

Fortunately, it is now easier than ever to check how much tax you have paid by using the HMRC app. Additionally, did you know that with careful management, you may even be able to mitigate how much tax you owe next year?

So, find out how using the HMRC app can help to ensure that you pay the right amount of tax, and what you could do to potentially reduce the size of your tax bill next year.

Use the HMRC app to check how much tax you have paid

In the past, working out how much tax you paid compared to what you should have owed used to be a more difficult process. It would involve checking all your paperwork, calculating the tax bill you think you should have paid, and then checking that the two matched up to one another.

If you discovered a discrepancy here, you would then have to spend time on the phone to HMRC to rectify it, a time-consuming and potentially frustrating thing to have to do.

Fortunately, you can now use the HMRC app to manage different elements of your tax position.

For current and previous tax years, you can check your tax codes and employment history if you are a PAYE taxpayer.

Additionally, you can also view your PAYE Income Tax history. With this information to hand, it can be easier to work out whether your tax bill is correct, rather than having to check through all your paperwork.

This can be useful for completing a self-assessment tax return, or for passing on to your accountant if they handle your tax position for you, too.

Beyond claiming a refund on any tax you have overpaid, the app offers a wide range of services, allowing you to:

- Check payments from your employer

- Register for self-assessment and make self-assessment payments

- Use the HMRC tax calculator to work out your take-home pay after deductions for Income Tax or National Insurance (NI)

- Track forms and letters you have sent to HMRC

- Report changes, from tax credit changes to updating your address.

In the 12 months to October 2022, HMRC reported that they received 3 million calls from people requesting information that they could have simply viewed on the app.

So, using the app will save you time when it comes to reviewing how much you have paid.

We can help you make your money even more tax-efficient

Even if you have paid the right amount of tax, you may be asking yourself: “Could I reduce my tax bill next year?”

While the answer will certainly depend on your personal circumstances, there are certainly things you can do to make your money even more tax-efficient.

Saving and investing through ISAs

One method for making your money more tax-efficient is by saving and investing through ISAs.

Each tax year, you can save and invest up to the ISA Allowance, standing at £20,000 in 2022/23. You can either save your money in a Cash ISA, invest it through a Stocks and Shares ISA, or even lend it to others through an Innovative Finance ISA.

Crucially, money held in ISAs is considered to be tax-efficient as it is entirely free from Income Tax, Capital Gains Tax (CGT), and Dividend Tax. That means you will face no tax on savings interest or investment returns that your money generates.

So, by using your entire ISA Allowance each tax year, you could limit the tax you have to pay on your wealth.

Withdrawing income from your business as dividends

Meanwhile, if you are a business owner, you could withdraw money from your company in the form of dividends.

There are two reasons that this can reduce your tax bill. Firstly, it allows you to make use of the Dividend Allowance, a tax-free threshold for dividend income.

In the 2022/23 tax year, the Dividend Allowance stands at £2,000. That means you can withdraw this sum from your business in dividend form without incurring a tax charge.

However, from April 2023, the Allowance will be reduced to £1,000, and then down to £500 from April 2024. So, you may want to make the most of the higher Dividend Allowance in this tax year while you still can.

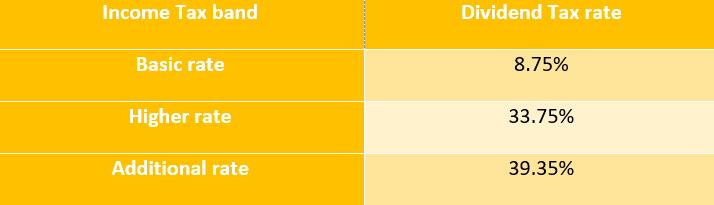

Additionally, the Dividend Tax rates can be more efficient than Income Tax. The rate of Dividend Tax you pay will depend on which Income Tax band you fall into, as shown in the table below:

As you can see, the Dividend Tax rate for a higher-rate taxpayer is lower than the 40% rate of tax you would pay on income you withdraw directly, as is the rate for additional-rate taxpayers who pay 45% Income Tax.

This means that withdrawing money as dividends rather than income from your business can still potentially be more tax-efficient, even if it exceeds your Dividend Allowance.

Get in touch

If you would like to find out more about reducing your tax bill, or need help with any other aspect of your money, we can help at DBL.

Email enquiries@dbl-am.com or call 01625 529 499 to speak to us today.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate tax planning.