Throughout 2022, and prevailing into 2023, inflation has been a top news story in the UK.

In July 2022, the Consumer Prices Index (CPI) indicated that inflation reached double figures for the first time in 40 years, the Office for National Statistics (ONS) reports. The CPI measures the average year-on-year change in the prices of goods and services purchased by UK households, based on a “basket” of 743 items.

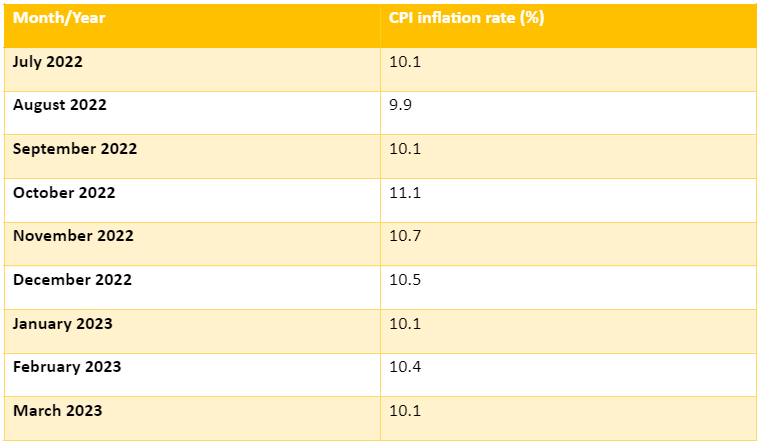

Since July 2022, CPI inflation has fluctuated slightly but remains high, coming to 10.1% in March 2023, as the below table reflects:

Source: ONS

Source: ONS

So, in March 2023, you may have paid 10.1% more for goods and services than you did in March 2022.

Worryingly, Aviva reports that the majority (56%) of Brits do not understand the impact of inflation on their savings.

As your spending power may be dissipating with the continued rise of inflation, you might be searching for answers about its direct impact on your wealth, and if there are ways you can combat its effects.

If so, read on to find out three ways your wealth could be affected by inflation, and what you can do to keep it at bay where possible.

1. Inflation is likely to increase your expenditure across many areas of your life

One of the biggest challenges inflation can pose to your wealth is that it can increase expenditure across multiple aspects of your day-to-day life, meaning its effects can be more widespread than you anticipate, even as a high earner.

For instance, you might have noticed an increase in the price of:

- Fuel

- Food

- Toiletries

- Energy bills

- Travel (such as public transport or flight prices)

- Clothes

- Monthly subscription services

- Hospitality, including hotels and restaurants.

A price hike in one or two of these areas may not feel like too much of a blow to your outgoings. But, with almost all prices rising at once over the last 12 months, this may have resulted in a surprising overall increase to your expenditure.

Especially as a high earner, you might already have significant monthly outgoings that, if they all jumped by an average of 10%, could raise your overall spending by a large margin.

While there is nothing you can do about the rising prices of goods and services, it could be prudent to ensure your monthly outgoings remain sustainable.

Although it is hoped that inflation will come down by the end of 2023, it is yet unclear when it will begin to slow, so working with a professional during this time could help put your mind at ease.

2. Inflation often leads to rising interest rates

You may be aware that, usually, central banks respond to rising inflation by increasing interest rates.

This is based on the theory that if interest rates go up and the price of borrowing money increases, consumers will have less money available to spend on goods and services. In turn, the dip in demand results in falling prices, calming inflation.

Indeed, this is the strategy the Bank of England (BoE) employed throughout 2022 and has continued to pursue so far in 2023.

When the Covid-19 pandemic hit, the BoE decreased its centralised interest rate, known as the “base rate”, to a historic low of 0.1%, where it remained until December 2021. Since then, it has raised the base rate 12 times, bringing it to 4.5% as of May 2023.

Rising interest rates can have both positive and detrimental effects on your wealth in a time of high inflation.

On one hand, borrowing is likely to be more expensive, as many lenders increase rates in line with the rising base rate.

Consider mortgages, for example. In April 2022, Moneyfacts data published by Mortgage Strategy reveals the average two-year fixed rate stood at 2.86%. In May 2023, the same mortgage agreement would carry a 4.59% rate, Moneyfacts reports.

All this to say: while inflation has continued to rise, any debt you carry may have become more expensive too.

On the other hand, compared with historically low interest during the Covid-19 pandemic, a 4.5% base rate may have improved the interest earned on your cash savings. Indeed, Moneyfacts reports that, on 11 May 2023, the best interest rate on a cash savings account was 3.71%.

So, if you held £50,000 in cash and earned 3.71% interest over the next 12 months, your savings would equal £51,855.

3. Your cash savings may lose spending power over the years

Despite a potential increase in interest on your savings over the past 12 months, it is important to remember that, while inflation remains as high as 10%, your cash may still be losing its spending power if it is not invested.

Indeed, while investing your wealth carries the risk of losses, it is one of the most effective tools for combatting the effects of rising inflation.

In just one of many examples of investment returns trumping inflation rates, The Times Money Mentor reports that in the 30 years to April 2023, the average annual return for the FTSE 100 was 7.3%, whereas the average annual growth in inflation was just 2.1% for the same period.

While inflation is of course much higher than 2.1% at the moment, over the long term, investment returns usually outstrip inflation.

Past performance is not a reliable indicator of future performance, and all investments carry risk, but if you are searching for a way for your wealth to keep pace with inflation long-term, investing it in a diverse portfolio of assets could be the way forward.

Get in touch

If you wish to inflation-proof your savings over the long term, or review your current expenditure while inflation remains high, then please do get in touch with us at DBL Asset Management.

Email enquiries@dbl-am.com or call 01625 529 499 to speak to us today.

Please note

This article is for information only. Please do not act based on anything you might read in this article.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it. Buy-to-let (pure) and commercial mortgages are not regulated by the FCA. Think carefully before securing other debts against your home.