Over the past couple of years, you may have been able to generate a greater return in interest on your savings, especially in the wake of record-low rates during the Covid-19 pandemic.

The Bank of England (BoE) increased its base rate 14 times consecutively between December 2021 and August 2023 in an attempt to slow the rapidly rising cost of living. This brought the rate, which broadly controls the interest rates you see on savings accounts, to 5.25% where it remained for nearly an entire year.

But, inflation fell to the annual BoE target of 2% in the 12 months to both May and June 2024, rising slightly to 2.2% in July. So, it is no real surprise that the Bank decided to finally reduce the base rate this month. Now, the base rate sits at 5%, and it is likely that savings rates will fall with it.

Even so, savings rates are still higher than they have been previously, allowing you to continue generating healthy returns on your saved wealth.

However, a potential unfortunate side-effect of the increased interest you might be able to generate is that you may have to pay Income Tax on some of it if you exceed certain thresholds.

This could especially be a problem for rugby players, as you are likely to have earnings that mean you exceed the allowance for tax-free interest.

So, read on to discover why you may have to pay tax on your savings interest, and what you may be able to do about it.

You can earn tax-free interest up to your Personal Savings Allowance

Before you have to pay tax on your savings interest, you can benefit from the Personal Savings Allowance (PSA). This is a threshold for how much you can earn in interest each tax year before tax may be due.

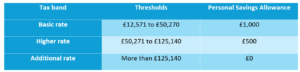

Your PSA depends on your marginal rate of Income Tax. The 2024/25 tax bands and PSA limits are outlined in the table below:

Low earners can use their Personal Allowance (£12,570 in 2024/25) to earn tax-free interest. Additionally, they may also benefit from the “starting rate for savings” of up to £5,000 of tax-free interest if they have earnings of less than £17,570.

While this may not necessarily be relevant to you, it may present other planning opportunities, such as alongside your spouse or partner (more on this later).

As a rugby player, it is likely that your income falls in the higher- or additional-rate bands, giving you a PSA of £500 at best.

While this may sound like plenty of interest to be able to enjoy tax-free, this period of higher interest rates means you do not need to have substantial savings to quickly exceed the PSA.

Consider this example. Using data from Moneyfacts as of 14 August, the highest interest rate available on an easy access savings account was 4.91%.

If you were a higher-rate taxpayer, that would mean you only need to have just under £10,500 in savings for one year before your interest starts to become taxable.

This issue is even more pressing for additional-rate taxpayers, as the £515 interest you could earn on these savings would be taxable at 45% from the moment you start earning it.

As you can see, you do not need to hold much in savings before you may have to start paying tax on the interest you earn. So, you may want to explore methods that allow you to mitigate tax on your savings interest.

Read on to discover three ways you may be able to do this.

3 ways to mitigate tax on your savings interest

1. Hold savings in the names of both you and your partner

Each individual has a PSA. So, if you and your spouse or partner both hold wealth in savings, you can increase the amount of interest that you are able to generate tax-efficiently.

This can be especially effective if your partner is in a lower tax band than you. For example, if you are an additional-rate taxpayer, you will not benefit from any PSA. But, if your partner pays basic-rate Income Tax, they will have a PSA of £1,000, and potentially more if they benefit from the starting rate for savings.

As a result, it could be sensible to hold savings in both your names so that you can generate greater sums of interest as tax-efficiently as possible.

2. Save in a Cash ISA

ISAs are tax-efficient savings and investment accounts. Each tax year, you can make contributions to your ISAs up to the ISA allowance, which stands at £20,000 in 2024/25. Any wealth contained in ISAs is then free from Income Tax, Capital Gains Tax (CGT), and Dividend Tax.

There are various kinds of ISAs, but the type that might be useful in this case is a Cash ISA.

When you save money in a Cash ISA, any interest your wealth generates is entirely free from Income Tax, regardless of which tax band you are in or how much of your PSA you have remaining.

Furthermore, these savings will not be liable for Income Tax when you come to withdraw them. So, a Cash ISA could be an effective way for you to save for the future, as you could use one to form part of a tax-efficient income when you have retired from playing rugby.

Your spouse also has their own ISA allowance, meaning they can save up to £20,000 in 2024/25 and enjoy the tax-efficient benefits of an ISA.

3. Make additional pension contributions

Aside from an ISA, another option you may want to consider is saving your wealth into your pension instead.

Wealth in your pension grows free from Income Tax and CGT. Furthermore, you can receive tax relief on contributions up to your Annual Allowance, which in 2024/25 is typically up to the lower of £60,000 or 100% of your earnings.

You may have a reduced Annual Allowance if your earnings exceed certain thresholds or you have already flexibly accessed your pension. Equally, you may be able to carry forward unused allowances from previous tax years.

Contributing your wealth to your pension rather than into savings can be a tax-efficient way to store your wealth and build a fund for your future.

Moreover, pension contributions do not typically count toward your taxable income. As a result, you could potentially move into a lower tax band by paying into your pension, increasing your PSA and allowing you to earn more tax-free interest on your savings elsewhere.

Bear in mind that you typically will not be able to access your pension savings before age 55, rising to 57 in 2028.

So, it is important not to contribute wealth to your pension that you would like to use in the short or medium term.

Get in touch

Need support managing your wealth as a rugby player? Then please do get in touch with us at DBL Asset Management.

From organising your finances so you can live the type of lifestyle you want, to finding strategies that mitigate tax on your savings and investments, we can help you make the most of your earnings.

Email enquiries@dbl-am.com or call 01625 529 499 to speak to us today.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate tax planning.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.