A recent report in FTAdviser confirms that HMRC has returned £30 million in overpaid Stamp Duty Land Tax (SDLT) over the past three years.

Moreover, the report also reveals that 61% of homeowners have never considered the possibility of errors in the amount of SDLT they paid.

These refunds largely relate to second properties, and, according to Homebuilding & Renovating, homeowners have seen an average refund of £27,000 for incorrect SDLT charges.

Discover the reasons why many people have overpaid SDLT, and how to ascertain if you may be affected and are due a refund.

SDLT is chargeable on property purchases

You are liable for SDLT when you buy a property in England and Northern Ireland and the value exceeds a certain threshold.

It is important to note that Scotland and Wales have their own distinct rates for similar taxes, which should be reviewed separately.

For property purchases up to £250,000, or £425,000 if you are a first-time buyer, you are exempt from SDLT.

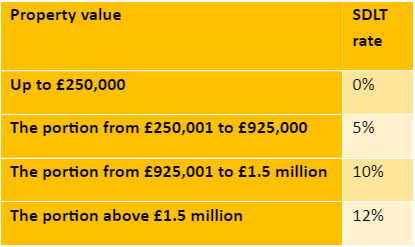

Above that, SDLT is charged at the following rates:

So, for example, if you are purchasing a home for £300,000, your bill would be £2,500, as you pay:

So, for example, if you are purchasing a home for £300,000, your bill would be £2,500, as you pay:

- No SDLT on the first £250,000

- A rate of 5% on the remaining balance of £50,000.

If you are buying a property that will not be your main home, such as a buy-to-let (BTL) property, or a second home, there is an SDLT surcharge of 3%.

Why you might have overpaid SDLT

Although the details in the section above appear to be relatively straightforward, SDLT can be a complicated tax.

The FTAdviser report suggests many individuals may have been wrongly advised to pay SDLT, and are subsequently not aware of the overpayment.

There are multiple areas where homeowners could have been charged incorrectly for SDLT, and where you can claim money back.

Two of the most common scenarios where this could be the case are:

- If you are buying multiple properties, often as part of a BTL property portfolio

- Becoming an “accidental landlord” by moving home and retaining your original property.

You could be eligible for multiple dwellings relief

The process of putting together a BTL property portfolio as an investment, as well as to create an income, is a common one.

Indeed, we are aware of rugby players taking this step to invest for both capital growth and income purposes.

In some instances, multiple dwellings relief (MDR) is available for purchasers of residential property who acquire chargeable interests in more than one property in a single transaction.

For example:

- You would be able to claim MDR if you purchased a single property with plans to subsequently divide it into rental units.

- MDR also applies if you purchase a number of flats in the same block, such as a new-build development.

In both of these scenarios, you may be able to claim MDR, even if construction or adaptation of the property concerned has not started by the date of the purchase transaction.

MDR will provide a reduction in the SDLT, as it effectively allows multiple uses of the lower-rate band. It is important to note that there is still a 1% minimum rate of SDLT, even when using MDR.

Many of the overpayments of SDLT referred to in the FTAdviser article stem from a lack of awareness of MDR.

You may become an “accidental landlord”

Becoming an “accidental landlord” is a scenario that can affect many people who have to move from one part of the country to another at relatively short notice.

Clearly, as a rugby player, this could affect you if you switch to a new club and end up with a property too far away that makes it impossible for you to use it as your primary residence.

In such circumstances, you may decide to keep your original property and rent it out, rather than sell it, and buy a further property close to your new club.

You will likely be charged SDLT with the 3% surcharge on your new residence. But crucially, you may be entitled to a refund of this higher rate if you sell the property within three years.

Even your solicitor may have been unaware of a potential overpayment

If you have encountered one of the scenarios you have read about in this article, you may be tempted to think that this is something that your solicitor will have dealt with, and will have ensured that you paid the correct amount of SDLT at the outset.

However, many solicitors will have relied on the HMRC online calculator, or an alternative that uses the same calculation process before coming up with a payable figure.

Such calculators are only intended to provide you with an outline guide and may not take into account the various reliefs and exemptions that may apply on some property purchases.

If you are in any doubt, it may be worth consulting with a tax specialist. This is especially the case if you are currently in the process of buying property and are concerned about potentially overpaying.

Get in touch

We do not advise on issues relating to property purchase or BTL, but if you believe you may be affected by any of the issues you have read about in this article, we will happily put you in touch with an expert who will be able to help you.

If you would like us to make such an introduction or would like to talk to us about any other aspect of your financial planning arrangements, please email enquiries@dbl-am.com or call 01625 529 499 to speak to us today.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate tax planning.