If you have a buy-to-let (BTL) property portfolio that creates an additional income stream for you, you will be well-aware that Stamp Duty Land Tax (SDLT) has always been an important financial factor when you are adding properties to your portfolio.

As a charge based on the value of the property you are purchasing, it has to be paid within 14 days of completion, and so can make up a big proportion of your upfront costs.

Changes announced in the Autumn 2024 Budget have already increased the amount of SDLT you will be liable for on investment property purchases.

Furthermore, the reduction in the property value threshold at which SDLT applies that was announced during the Covid pandemic will be reversed from 1 April.

Read about what these changes will mean, and some steps you could consider to help mitigate the effects of increased costs.

Changes to Stamp Duty mean you will pay more when you add properties to your portfolio

First and foremost, it is important to be aware of the change from the Autumn Budget that will affect the SDLT you face when buying property for your portfolio.

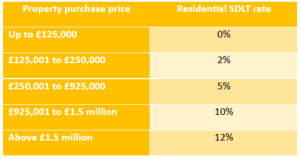

The table below shows the rates of SDLT that have been chargeable since 2022:

There is also an SDLT surcharge on additional properties, such as investment properties. Pre-Budget, this stood at 3%.

As an example of how these rates worked, imagine that you purchased an investment property valued at £300,000 before the Autumn Budget. In this case, you would have paid:

- 5% SDLT on the portion between £250,001 and £300,000 = £2,500

- 3% surcharge on the total purchase price of £300,000 = £9,000

- Total SDLT payable = £11,500

However, in the Budget statement last October, the surcharge on additional properties was increased from 3% to 5%, starting from 31 October.

So, since this point, the SDLT on a £300,000 investment property would have been calculated as follows:

- 5% SDLT on the portion between £250,001 and £300,000= £2,500

- 5% surcharge on the total purchase price of £300,000 = £15,000

- Total SDLT payable = £17,500

Crucially, the thresholds that were put in place in 2022 will be reversed from 1 April 2025. This will see the tax-free residential SDLT threshold reduced from the current £250,000 to £125,000.

This table shows the SDLT rates that will apply from 1 April 2025:

This means that from 1 April 2025, the total SDLT you would be liable for in the case of a £300,000 investment property would be:

- 2% SDLT on the value between £125,001 and £250,000 = £2,500

- 5% SDLT on the value between £250,001 and £300,000 = £2,500

- 5% surcharge on the total purchase price of £300,000 = £15,000

- Total SDLT payable = £20,000

As you can see, this is a marked increase, particularly looking back to before the Autumn Budget. Indeed, that marks an increase of 73.9% from before the Autumn Budget in October 2024 to April 2025.

This is a significant additional burden if you are looking to expand your portfolio of properties. So, you may want to consider finding strategies that may help reduce the impact of such a rise.

Here are some suggestions as to possible steps you can take to help mitigate the effect of increased SDLT charges.

1. Consider alternative types of residential property lets

If all the properties in your portfolio are clustered in one area, such as in the town or city where you play rugby, and are of a similar size and type, it may be beneficial to consider diversifying your property holdings.

Some possible alternatives you may want to think about could include:

- Cheaper property with reduced upfront costs. This may involve identifying properties in different areas to where you are now.

- Furnished holiday lets, which can provide a greater income than standard residential properties. You would have to factor in the potential seasonal nature of letting income with this type of property.

- Converting larger properties into houses in multiple occupation (HMOs), which can increase the rental yield by letting to a series of tenants rather than a traditional BTL arrangement.

There are pros and cons associated with all these options, and we would recommend you take professional advice before moving into different types of residential letting.

2. Include commercial or mixed-use property in your portfolio

The SDLT payable on the value of commercial properties is substantially lower compared to residential purchases.

For example, on a commercial property with a purchase price of £300,000, the SDLT would be:

- 2% SDLT on the value between £150,001 and £250,000 = £2,000

- 5% SDLT on the value between £250,001 and £300,000 = £2,500

- Total SDLT payable = £4,500

It is worth noting that mixed-use properties, such as residential flats above shops, will also qualify for these lower rates of SDLT.

However, the commercial letting market is driven by different types of demand than you may be used to with purely residential properties. So, again, you may want to seek professional advice before expanding into this sector.

3. Set up a limited company for owning your properties

While setting up a limited company to manage your property portfolio is likely to involve additional administration and company reporting costs, there are some potential advantages in doing so, rather than trying to manage your portfolio as an individual.

This is especially the case if you have a substantial number of properties that you let.

A limited company can provide you with more flexible taxation options when it comes to drawing income from your portfolio.

Additionally, managing your portfolio through a company structure may provide you with access to reliefs in relation to your mortgage borrowing. By carefully planning your borrowing and optimising loan-to-value ratios, you could effectively manage both your taxable profits and cash flow more advantageously.

Furthermore, from a longer-term perspective, owning property through a company can often be more tax-efficient when it comes to passing your portfolio to your beneficiaries.

Facing up to the new challenges you could face with your property portfolio

The changes in SDLT that you have read about here will certainly be impactful in terms of increasing your upfront costs when buying property. So, it is important for you to be proactive when it comes to mitigating the effects on your financial position.

Reviewing all aspects of your portfolio, such as the type and location of the properties you own, your company structure, and your borrowing commitments, could help you find some valuable flexibility that might assist you in overcoming the increased costs you may face.

You may also want to consider reviewing any currently ongoing transactions to ensure they are financially viable and still align with your long-term strategy.

Get in touch

If you need support managing your wealth as a professional rugby player, then please do get in touch with us at DBL Asset Management.

We appreciate the challenges rugby players face in organising their finances. Email enquiries@dbl-am.com or call 01625 529 499 to speak to us and find out how we could help today.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

The Financial Conduct Authority does not regulate tax planning, and buy-to-let (pure) and commercial mortgages.

Think carefully before securing other debts against your home.