After a lengthy wait since the general election at the beginning of July, and in the wake of much media speculation about the contents, the Labour chancellor, Rachel Reeves finally delivered her 2024 Autumn Budget on 30 October.

This outlined the fiscal objectives and financial plans of the new government for this tax year and beyond.

The Labour Party had confirmed in their election manifesto that they would not increase Income Tax, employee National Insurance, or VAT, and the chancellor re-affirmed this pledge in her Budget speech.

However, she also announced that her Budget would raise taxes by £40 billion, to help fill a “financial black hole of £22 billion” and to invest in public services, such as the NHS.

Read about seven of the key measures announced and discover how some of the tax increases could affect you as a rugby professional.

1. The freeze on Income Tax thresholds will end in 2028

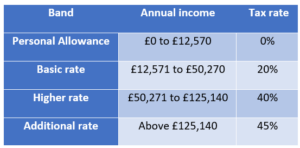

Income Tax thresholds are the rate at which you start paying certain levels of tax on your earnings.

The current thresholds are outlined in the table below:

Up until 2021, thresholds were increased each year, usually in line with inflation. However, in 2021, the then-chancellor, Rishi Sunak, froze Income Tax thresholds until 2026.

Then, in the 2022 Autumn Statement, chancellor Jeremy Hunt extended this freeze until 2028.

The result of freezing these thresholds means that more of your salary could become subject to higher rates of tax as your earnings increase each year.

Contrary to pre-Budget media speculation, Rachel Reeves did not extend the freeze beyond 2028. Instead, she confirmed that from 2028/29, personal tax thresholds will be uprated in line with inflation once again.

2. The Stamp Duty payable on additional properties has increased

If you have a property portfolio, or you are thinking of developing one to provide you with an additional source of income outside the game, you are likely to be affected by an increase in the Stamp Duty Land Tax (SDLT) surcharge.

With effect from 31 October 2024, the SDLT surcharge on the purchases of second homes, and buy-to-let residential properties, increased from 3% to 5%.

This means that if you purchase a second or additional property for £300,000, you will now be liable for £17,500 in SDLT.

3. There will be no change to ISA contribution limits until at least 2030

There was some good news if you save or invest money in a tax-efficient ISA.

Before the Budget, there was speculation that the chancellor may make changes to simplify the ISA regime, or even limit the amount you could accrue in your ISA fund.

However, Rachel Reeves confirmed that the current ISA annual subscription limit will remain at £20,000 until at least 5 April 2030.

ISAs could be a key part of your saving and investing strategy, so this confirmation may provide useful reassurance with regard to your future plans.

4. You might pay more tax on your investment profits

Profits you make from investments you hold outside tax-efficient options such as ISAs and pensions may be liable for Capital Gains Tax (CGT), and the chancellor announced several changes to the CGT regime.

The main rates of CGT increased with immediate effect. The basic rate has risen from 10% to 18% and the higher rate has increased from 20% to 24%. This brings them into line with the equivalent rates of CGT payable on the sale of any residential property that is not your main residence. This could mean you pay more tax when liquidating assets.

The Annual Exempt Amount, which is the amount of profit you can generate in a single tax year that is not liable for CGT, will remain at £3,000.

5. Pension assets will no longer be exempt from Inheritance Tax

While it may be a long time in the future, it is often sensible to think about your legacy planning, especially if you are married or in a civil partnership, or have children.

As well as ensuring that your assets pass to your intended beneficiaries when you die, it is also important to consider the amount of Inheritance Tax (IHT) your beneficiaries could pay on the value of your estate after you are gone.

Relevant to this, the chancellor made an important announcement that you may well want to take into account as part of your estate planning.

At present, your pension fund does not normally form part of your estate for IHT purposes.

However, in her Budget announcement, Rachel Reeves revealed that this exemption for pension assets will end in 2027. So, if you planned to tax-efficiently pass on part of your estate through your retirement fund, this will no longer be possible from 6 April 2027 under current plans.

6. Hospitality and leisure businesses could benefit from lower rates

If you are looking ahead to your career after rugby, or you already have business interests in the hospitality and leisure sectors, there was some welcome news from the chancellor in respect of business rate relief.

To support businesses in these sectors, some properties will receive 40% relief on their bills in the 2025/26 tax year, up to a maximum of £110,000 per business.

Furthermore, she announced that, from 2026/27, new lower tax rates will be introduced for retail, hospitality and leisure properties.

7. Your post-match celebrations could be cheaper

Finally, another bit of good news!

The chancellor confirmed a reduction in the duty for draught alcohol, cutting this on an average strength pint by a penny.

However, rates for non-draught products, such as bottled beer, spirits and wine, will increase in line with the Retail Prices Index (RPI) from 1 February 2025.

Get in touch

If you have any queries or concerns as to how the Budget could affect your financial planning, then please do get in touch with us at DBL Asset Management.

Email enquiries@dbl-am.com or call 01625 529 499 to speak to us today.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate estate planning or tax planning.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.