When it comes to buying a property, you will no doubt find that the bulk of your financial commitment will be the mortgage you take out (if you need one) and the deposit you have saved up to put towards or entirely settle the purchase price.

But when you feel the time is right to get your feet on the housing ladder, or look to create or expand a property portfolio, a key part of your planning is being aware of some of the other associated costs that you may be liable for.

You will need to factor these into your financial arrangements as, while some can be added to a mortgage loan, you will need to pay the others either before, or shortly after you complete on the purchase.

Here, you can read about some of the key additional costs and get a rough idea of what these may be.

Please note that all the figures quoted here are based on average costs as of March 2024.

1. Paying your solicitor to act on your behalf

Your solicitor will play a key role in your property purchase.

They will do a lot of the heavy lifting on your behalf, dealing with all the negotiations with the seller, and arranging all the necessary searches, including those from the Land Registry and local authority.

Your solicitor will flag up any potential issues relating to your new property, and manage the eventual exchange and completion dates, and transfer of funds.

Legal fees are typically in the region of £850 to £1,500. On top of that, searches are likely to cost around £300, and there will be an additional charge of around £50 for the electronic transfer of the mortgage funds.

Because of the important role your solicitor will play, it makes sense to take some time and select one you are happy with. You will need to confirm their details very early on in the application process, so selecting them should be near the top of your “to-do” list.

2. Mortgage arrangement costs, charged by your lender

Once you have your solicitor in place, the next potential charge to be aware of relates to your mortgage if you are using one.

While the obvious outgoing will be your monthly repayments, you will also need to factor in other fees.

For example, some lenders may charge a booking fee, which effectively secures the interest rate you are offered and agree to at the outset. This will usually be up to £250.

There is also likely to be an arrangement fee, which is the charge the lender will make for setting up your mortgage. This will often be expressed as a percentage of the amount you are borrowing, with this usually varying between 1-3%.

You may find it better to pay these charges up front if you can, rather than adding them to your mortgage. Otherwise, you will pay interest on them for the term of the loan.

3. Stamp Duty payable to the government

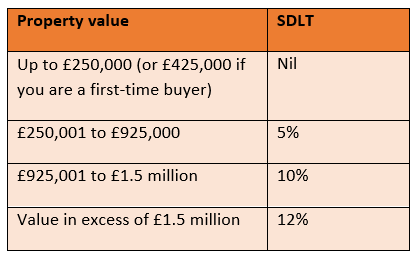

You will pay Stamp Duty Land Tax (SDLT), a property tax in England, on properties costing more than £250,000.

However, if you are a first-time buyer, you will not pay SDLT on any property up to the value of £425,000, unless the property price is over £625,000.

The table below shows the current SDLT rates in the 2024/25 tax year:

While SDLT is charged on the total value of the property, it is payable on the applicable charging bands, rather than the whole value.

For example, if you are a first-time buyer purchasing a property valued at £500,000, you would pay SDLT of 5% of £75,000 (the amount over £425,000) so a total of £3,750.

When purchasing second homes or property as part of an investment portfolio, there is an additional 3% SDLT charged on top of the rates in the table.

4. The property valuation and any survey you may feel is necessary

As part of your application, your mortgage lender will arrange for the property you are looking to buy to be valued by a surveyor.

The cost of this will be subject to the size of the property and the notional value, and can vary from £150 to £1,500.

In some cases, the lender may offer a free valuation as part of the mortgage you are taking out, so it is worth seeing if such offers are available to you.

It is important for you to bear in mind that a property valuation report is not the same as a full structural survey. While it may point out some obvious issues, it is unlikely to tell you of all the repairs and maintenance that might be needed.

Because of this, you may want to consider getting your own survey conducted, especially if you are buying an older property.

There will clearly be a cost, which can range from £600 to £1,000, but this outlay could well save you a lot more than that in the long run.

5. Removal costs

If you are buying your first home, the amount of furniture and other possessions you are moving could be minimal and you may be happy with a DIY approach to moving. You may be able to simply hire a van and get some mates to help you.

But, if you are moving a lot of furniture and other items, you might want to get professionals in to do the job for you, particularly if you are moving a long distance.

Meanwhile, if you are buying a property as an investment to let and plan to furnish it for your tenants, you may need to consider the cost of doing so.

As with any service, it is prudent to set out your removal requirements and then to shop around.

Be aware that some removal companies will offer secure storage facilities if there is a time lag between you having to leave one property and move into another.

6. Various insurance costs

Your mortgage lender will typically require you to take out buildings insurance to protect your new home against damage from threats such as fire, subsidence, or flooding.

Although it is not usually a condition of the mortgage, it is also a good idea to have contents insurance set up for all your possessions.

You may also want to ensure you have sufficient life insurance to enable your family to pay off the outstanding loan should you die before you have cleared your mortgage.

If you are buying any property to let, you should note that a standard home insurance policy will generally not cover you for any rental activities. It is likely that, if you have a mortgage, your lender will require you to have suitable insurance in place before you take on tenants.

Again, as with all types of insurance, it can be advantageous to shop around to find the right option for you.

7. The cost of making any new home habitable

While it is not an actual quantifiable charge like the other potential costs you have read about here, you may want to consider how much money you will need to spend on “day one”, or at least very soon after, to ensure you can live in your new home, or rent it out straightaway.

Although you may have a decoration and refurbishment plan, there may be some essential work, such as electrical wiring or plumbing, that will need to be carried out before you can move in or put the house on the rental market.

Then there will be the items that you could live without but can make a house into a home, such as carpets, cooker, and washing machine. Remember to factor these in, too.

Get in touch

If you would like advice about any aspect of your financial planning, then please do get in touch with us at DBL Asset Management.

Email enquiries@dbl-am.com or call 01625 529 499 to speak to us today.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

The Financial Conduct Authority does not regulate buy-to-let (pure) and commercial mortgages.

Think carefully before securing other debts against your home.