According to Professional Adviser, Inheritance Tax (IHT) receipts in the United Kingdom amounted to approximately £8.2 billion in 2024/25. This was an increase of 10% on the 2023/24 figure.

There are various reasons for this increase:

- The nil-rate band above which IHT is payable has been frozen since April 2009.

- The additional residence nil-rate band has also been frozen since 2020. Both bands are frozen until 2030.

- Residential property values are at an all-time high, adding to the value of your assets.

- Stock markets have enjoyed a period of sustained growth, which may have boosted the value of investments.

An additional reason may well be a lack of understanding, as a recent survey published by Unbiased revealed that 71% of UK adults do not understand IHT and how it is applied.

Inheritance Tax is charged depending on the value of your estate

IHT is actually a relatively simple tax to understand. When you pass away, your estate will pay 40% tax on the value of your assets above the nil-rate band. In 2025/26, this stands at £325,000, and there is also a residence nil-rate band (up to £175,000 in 2025/26) that applies if you leave your main home to your direct descendants, such as children or grandchildren.

This means that you could leave up to £500,000 to your loved ones free from IHT.

Any value above these thresholds could be subject to a 40% tax charge. Fortunately, an effective way to reduce your liability is through gifting assets. Here you can discover five ways you can do this.

1. Pass your assets to your spouse or civil partner on your death

The first gift is the most straightforward. If you are married or in a civil partnership, your entire estate can pass to your spouse or civil partner when you die.

Furthermore, regardless of the amount, no IHT will be payable if your spouse or civil partner pre-deceases you.

Their unused nil-rate bands will also pass on to you, meaning that you could leave a legacy of up to £1 million when you die with no IHT being payable.

2. Make use of your gift exemptions

There are various other gifts you can make to help reduce the value of your estate for IHT purposes.

For example, each year you have a gifting exemption, standing at £3,000 in 2025/26. This can also be carried forward to the following year. So, if you did not use it in the 2024/25 tax year, you can gift up to £6,000 this year.

It is also worth remembering that £3,000 is the individual exemption. So, you and your partner can gift £6,000 a year between you (or up to £12,000 if neither of you used your exemption in the previous year).

Additionally, you can make gifts to a couple for their wedding or civil partnership, which will immediately fall outside your estate for IHT. These are up to:

- £5,000 to a child

- £2,500 to a grandchild or great-grandchild

- £1,000 to another family member or friend.

You can also make small gifts of up to £250 to anyone you have made no other gifts to.

Regular use of these allowances and exemptions can reduce your liability over an extended period.

3. Make other gifts that could be potentially exempt from IHT

Outside of the specified exemptions and allowances, you can theoretically gift as much money or assets from your estate as you like to anyone. These gifts are known as “potentially exempt transfers” (PETs) as the amount of IHT payable depends on how long you live after making the gift.

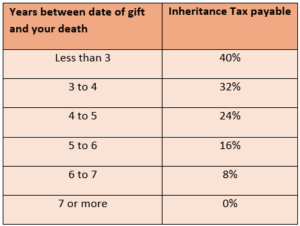

Under a system of “taper relief”, the longer you live after making a gift, the less IHT will be payable by your beneficiaries. After seven years, no IHT will be payable.

You should note that taper relief only applies to gifts in excess of the nil-rate band.

4. Use the “gifts out of surplus income” facility

One often overlooked option you could utilise to reduce your IHT liability is to make gifts out of your surplus income.

It is a potentially effective method, yet Today’s Wills and Probate confirm that just 2% of estates have used this facility.

It means that if you make regular gifts from your income, such as paying the care costs of elderly relatives, or school fees for children or grandchildren, these may no longer form part of your estate.

There are three rules that such gifts must adhere to:

- They must be made from your income, and not from savings or investments.

- The gifts must be made on a regular basis, normally monthly.

- You should be able to maintain your usual standard of living.

As you can imagine, given these requirements, it is important to keep accurate records of the gifts you make in this regard. These should confirm the amount of the gifts, as well as the dates and recipients.

5. Gift assets by means of a trust

In simple terms, a trust is a legal agreement that moves money out of your direct ownership with the intention that it will pass to someone else, usually on your death.

Because these assets will no longer be in your control, they are considered to be outside of your estate when calculating IHT.

However, while this may sound a straightforward way to gift assets, it is important to note that the rules around trusts and IHT are complex, and we would recommend that you take professional advice before setting these up.

For example, the seven-year rule you read about in respect of PETs may apply to some gifts in trust when they are being assessed for IHT.

Additionally, you may still be liable for tax on these assets. For example, you will usually pay 20% on the amount of the assets placed in trust that exceed your nil-rate band. The assets will then be revalued every 10 years, and a tax of 6% could be payable on the amount above your nil-rate band.

Inheritance Tax rules around pensions are changing from April 2027

Up until now, most pension funds have been exempt from consideration for IHT. This has meant that using other assets to provide retirement income while leaving your pension untouched has been an effective way to pass a substantial sum to your beneficiaries.

However, from 2027, this is set to no longer be the case, with plans for pension assets to be included as part of your estate.

This means that a key part of your estate planning, as well as considering some of the measures you have read about here, will be to review any arrangements you may have previously made in respect of your pension fund.

Get in touch

If you would like advice on making gifts and reducing your potential IHT liability, please get in touch with us at DBL Asset Management.

Email enquiries@dbl-am.com or call 01625 529 499 to speak to us today.

Please note

This blog is for general information only and does not constitute advice.

The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

The Financial Conduct Authority does not regulate estate planning, tax planning, trusts, or will writing.